Adjusted gross income calculator hourly

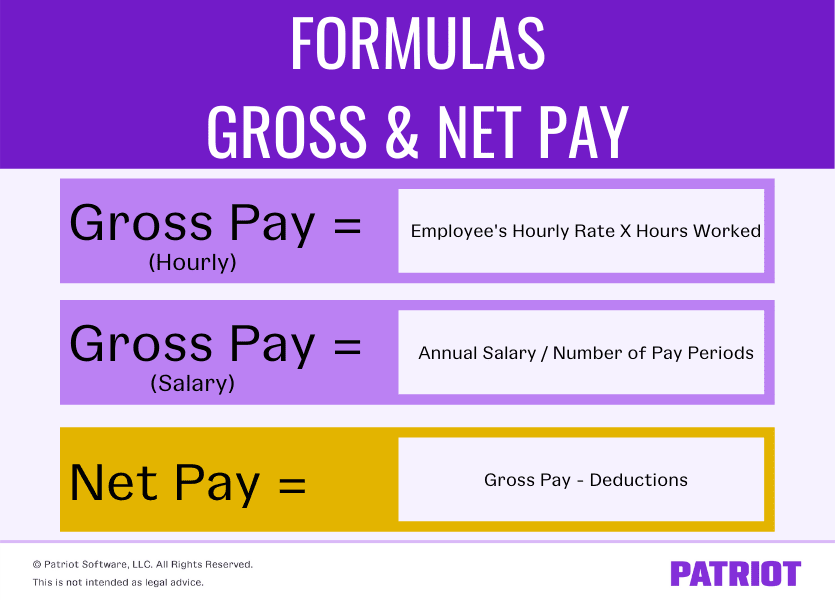

Gross Pay or Salary. Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary.

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

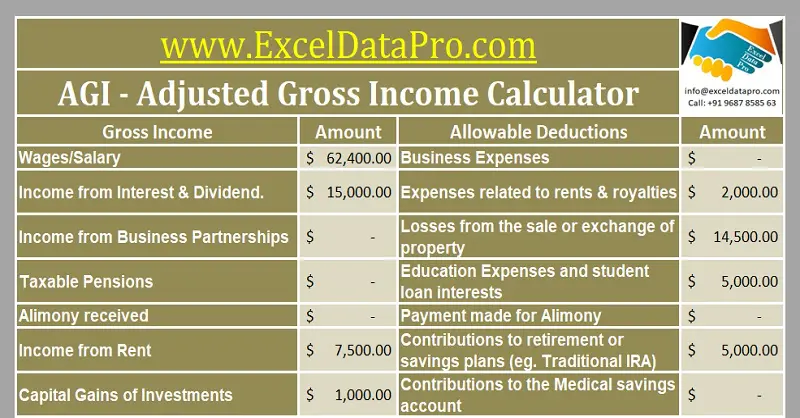

Calculator Use Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime.

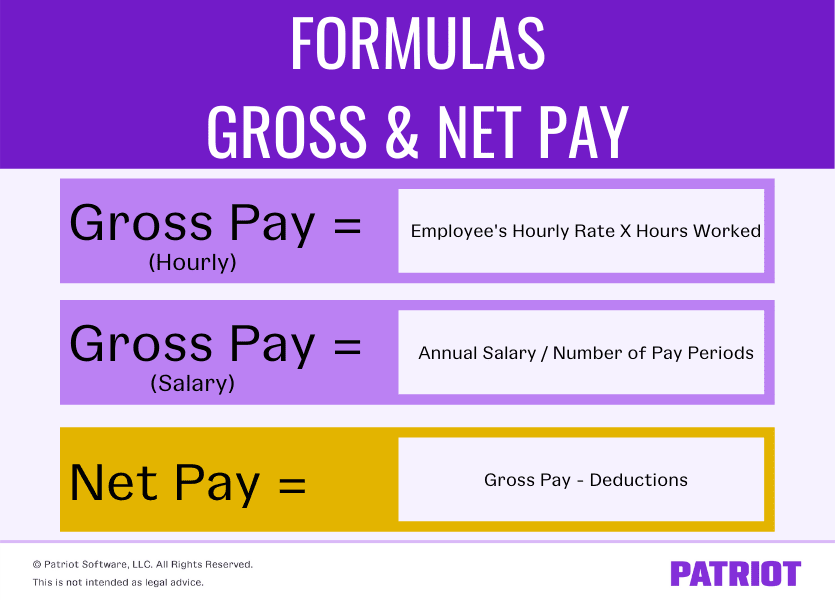

. How To Calculate Adjusted Gross Income To calculate your AGI start with your gross income and subtract all eligible above-the-line deductions. To begin your adjusted gross income calculation youll need to gather all of your income statements. How to calculate adjusted gross income.

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. AGI Calculator AGI cannot. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be.

It is necessary to collect value from all sources needed for gross income to the end of the year. To enter your time card times for a payroll related calculation use this time card calculator. Find your income statements.

Sally is able to claim a total of 4000 of income adjustments. How to calculate my modified adjusted gross income MAGI. Doing agi calculation by using adjusted gross income formula.

With five working days in a week this means that you are working 40 hours per week. Your gross income includes your wages. 2 Deduct the following items.

You can locate your federal gross wages on your W-2 form. How to use the AGI calculator Step 1 Select your filing status Step 2 Enter all eligible income Step 3 Input all eligible deductions Step 4 Click calculate. Adjustments to Income include such items as.

If you prefer to only look at salary see the salary percentile calculator here. Break the taxable income into tax brackets the first 10275 x 1 10. A better income is probably 89452 the 75th percentile of earnings for 40 hour workers.

The next chunk up to 41775 x 12 12. Gross income does not include gifts and inheritances tax-free Social Security benefits and tax-free interest from state or local bonds. AGI Gross Income Adjustments To Income Gross Income 500 Adjustments To Income 23335112.

60000 1800 5000. And the remaining 15000 x 22 22 to produce taxes per bracket of 1025 3780 3300 total tax bill of 8105. For a final figure take your gross income before adjustments.

How to calculate adjusted gross income. Gross income includes your wages dividends capital gains business income retirement distributions as well as other income. She subtracts 4000 from 66800 to find her adjusted gross income which is 62800.

Adjusted gross income is your gross income minus your adjustments. Lets say that your hourly wage is 15 and you work eight hours per day from Monday to Friday.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Salary Calculator

Gross Income Calculator Top Sellers 52 Off Www Wtashows Com

Salary Calculator With Taxes Best Sale 55 Off Www Wtashows Com

What Is Adjusted Gross Income And How To Calculate It Hourly Inc

Hourly Paycheck Calculator Step By Step With Examples

Gross Income Calculator Online 56 Off Www Wtashows Com

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Agi Calculator Adjusted Gross Income Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

How To Calculate Gross Pay Youtube

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly Paycheck Calculator Step By Step With Examples

How To Calculate Adjusted Gross Income With An Hourly Wage

Calculating Income Hourly Wage Youtube

How To Calculate Gross Income Per Month